Purchase loan options

Connect with a Mortgage Advisor

There’s a lot to learn when you’re ready to purchase your first home. Our team will explain each step, so you feel informed and confident.

Get pre-approved before you shop

Set your goals, figure out your budget, and get pre-approved. This way, you know exactly what you can afford before you start house hunting.

Get the keys!

Nothing makes us more excited than taking you to the finish line – the front door to your first home.

Affordability Calculator

Enter your information to estimate what your monthly payment may look like.

First time home-buyer FAQ

You have questions. We have answers.

It’s a common misconception that you need 20% down to buy a home. There are different options available that allow you to obtain a loan with a lower down payment.

Not necessarily. There are many different types of loans with varying credit score requirements.

The three most common home loan types are Conventional, FHA and VA, if eligible. You can learn more about these loans here

Our experienced Mortgage Advisors will give you the guidance you need so you can choose the program that best fits your needs.

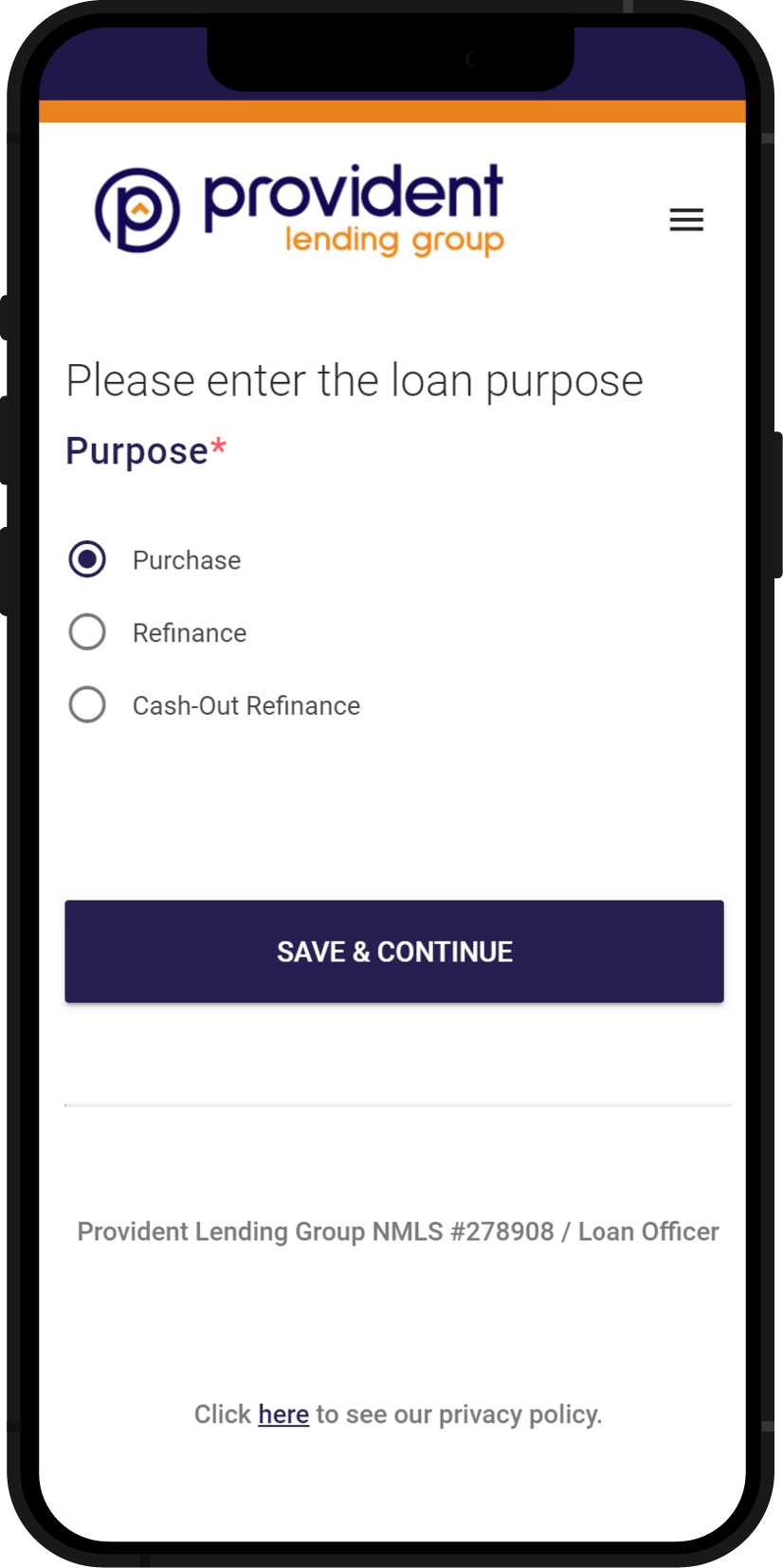

We strive for simple

We’ve crafted (and perfected) our streamlined process based on feedback from clients, employees, and partners.

- Choose your communication mode

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Share your goals

Type them up via our simple online application – or talk it through with a friendly advisor. Either way, we’ll help you determine your best options before you apply.

- Submit your application

Our team will carefully review your loan application along with all other requirements, like employment and credit history.

- See you at the finish line

Finalizing loans are music to our ears. Once your loan is approved and all conditions are met, we’ll work with you to set up a date to close on your loan. Hooray!

Purchase loan options

mortgage loan types to choose from – and we’ll help guide

you toward the option that’s best for you.

- Alternative Home Loans

Loans that are not required to meet standard agency documentation requirements